Apple built its business by innovating. But lately, it’s been leaning on diplomacy.

Tim Cook, Apple’s chief executive, recently scored exemptions from tariffs on exports of Chinese-made iPhones. The maneuver freed Apple to focus on business, and lately, business has been good.

A new, lower-priced iPhone, which the company introduced in February, and strong sales of apps and services helped the company make $24.78 billion in quarterly profit, a 4.8 percent increase from a year ago, Apple said on Thursday. The company’s sales rose 5 percent to $95.36 billion.

The results exceeded Wall Street analysts’ expectations for $24.37 billion in profit and $94.35 billion in sales. Shares fell more than 2 percent in after-hours trading.

Apple’s steady performance came amid turbulence. In just a few months, the company has had to navigate internal and external obstacles, including the failures of its much anticipated artificial intelligence system and the challenges of the Trump administration’s punishing tariffs on products made abroad.

Last month, shares of Apple plummeted after President Trump imposed tariffs of 145 percent on exports from China, where Apple makes 80 percent of the iPhones it sells, as well as tariffs on other countries that make iPads and Macs like Vietnam. The tariffs erased about $770 billion of the company’s market value in four days.

Wall Street analysts predicted Apple would have to increase iPhone prices to $1,600, from $1,000. Some customers raced to buy iPhones before prices went up, helping lift sales.

But three months after personally donating $1 million to Mr. Trump’s inauguration, Mr. Cook pressed the White House to relax its tariffs and persuaded the Trump administration to temporarily relent.

On Thursday, Apple said sales of iPhones, its most important business, rose 2 percent to $46.84 billion over the quarter. The company increased iPhone sales by more than 10 percent in Japan, India and the Middle East, helping it claim the largest share of smartphone sales in the world over a three-month span, according to Counterpoint Research, a market research firm.

The company continues to struggle in China, where it reported its sixth quarter of sales declines. Total revenue from the region was $16 billion in the quarter, down 2 percent from a year ago.

“Everything is OK for right now because no prices have been raised,” said Ben Bajarin, principal analyst at Creative Strategies, a tech research firm. “The question is: If more tariffs hit, then what happens?”

The company’s services business, which includes sales from apps, Apple Music and Apple Pay, outshined its devices. Apple reported revenue for the business of $26.65 billion, an 11.6 percent increase from last year.

But the future of Apple’s services business is uncertain. In an antitrust case on Wednesday, a federal judge rebuked the company for its business practices and ruled it can’t collect a commission of 27 percent on app sales made outside the App Store. Her order allows apps to cut Apple out of their business, muffling one of the company’s most important sources of revenue.

In a separate antitrust case, Apple could lose $20 billion in services revenue that Google pays to be the automatic search engine on iPhone web browsers. A federal judge ruled last year that Google had broken the law to maintain a search monopoly. This month, he convened a hearing to address its illegal behavior, including remedies that could include restrictions on Google’s payments to Apple.

The company’s device business also faces questions. Last year, Apple revealed a generative A.I. system capable of improving emails, summarizing notifications and upgrading its virtual assistant, Siri. It promoted the system, which it called Apple Intelligence, as a major reason to buy a new iPhone. But in March, the company pulled its advertisements promoting the features and said some would be delayed until this fall.

More Stories

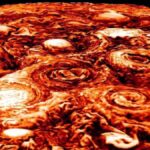

Juno Mission Sheds Light on Jupiter’s Storms and Volcanic Activity on Io

How a U.S. Tax Loophole Supercharged China’s Exports

The Dangers of A.I. Flattery + Kevin Meets the Orb + Group Chat Chat