BBC Business reporter

Getty Images

Getty ImagesFalling petrol prices drove UK inflation down by more than expected in the year to March.

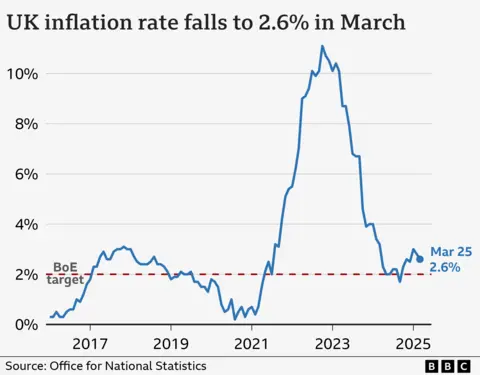

Inflation was 2.6%, down from a rate of 2.8% in February, according to official data.

But the fall may only be temporary as analysts say it’s expected to spike from April as rising bills and higher business costs take hold.

“The only significant offset came from the price of clothes which rose strongly this month,” said Grant Fitzner, chief economist at the Office for National Statistics (ONS).

The inflation decrease was also driven by a drop in recreation and culture prices, with toys, games, and hobbies falling particularly sharply.

Wages continue to outpace inflation with salary raises for public sector workers growing more than those in the private sector.

The average rise in wages was 5.9%, data released by the ONS on Tuesday showed.

The drop in inflation will be welcome news to the government, said Lindsay James, investment strategist at Quilter.

“With the jobs market weakening somewhat, and very real and present tariff threats still in play, any downward pressure on inflation will be hailed,” she said –

She added the forecast for inflation “remains very uncertain” because of a “volatile” global economy, and rising National Insurance which she said will raise prices from April onwards.

More Stories

Council confirms £4m cost of living support

Easter 2025 supermarket opening hours: Tesco, Asda, Aldi, Sainsbury’s and more

Yes Bank Q4 profit surges 63% YoY to Rs 738 crore, NII beats estimates