Gold prices have been skyrocketing and how! Gold MCX futures have breached the Rs 1 lakh mark, a historic first for the yellow metal. Gold has always been seen as a safe haven asset in times of uncertainty. Concerns over global economic growth, escalating China-US trade war are driving the rise in gold prices, with a weaker dollar having added to the momentum.

Experts believe that fundamentally markets are pricing in increased geopolitical risks, fuelled by US President Donald Trump’s trade policy tensions and stagflation concerns which could continue to drive further gains for the yellow metal.

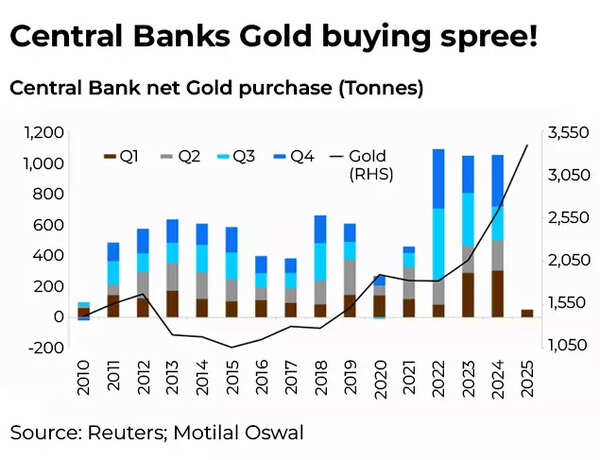

Central banks around the world have been on a gold buying spree for several quarters and have shored up their gold reserves to new highs. Incidentally, RBI has not only been buying gold, it has also been shifting significant quantities back to India.

Central banks on gold buying spree

But with the precious metal crossing the Rs 1 lakh mark – the important question in the minds of investors is – is the gold rally sustainable? How much steam is left in this rally? Also, should you be buying gold at such high levels, or is it time to book profits? We ask experts:

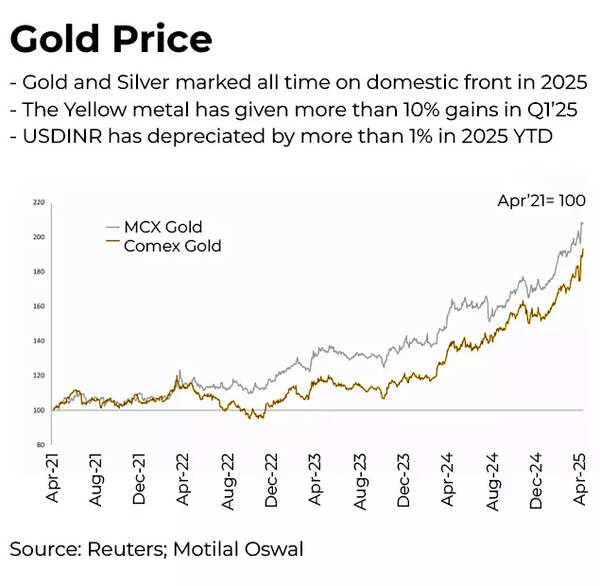

Rise of Gold

Naveen Mathur, Director – Commodities & Currencies, Anand Rathi Shares and Stock Brokers points out that gold has seen exceptional performance since the start of the year. It has risen over 21% till date, touching new record highs more than 20 times this year.

According to a PTI report, 20 years ago in April 2005, gold was trading at Rs 6,267 per 10 grams on MCX. It has risen steadily through various global economic rises such as the 2008 financial meltdown, COVID-19 pandemic and Russia-Ukraine conflict.

In April 2025, gold hit its all-time high level of Rs 1,00,000 for the August month delivery, which is a 41% surge in just 12 months.

Gold Price

Abhilash Koikara, Head Forex & Commodity, Nuvama Professional Clients Group has a target for gold prices at $3,930 levels in dollar terms. According to Koikara, on MCX gold prices can test Rs 1,12,000 levels by December 2025.

NS Ramaswamy, Head of Commodity at Ventura sees gold continuing to be an attractive investment bet under the current global conditions. Price predictions for gold are being made on these premises and can fluctuate based on subsequent changes in the market conditions. Factors like inflation, central bank demand, and economic uncertainty will continue to influence gold prices, he said.

“We believe that the prices in this euphoria may rise sharply this year to $3700 an ounce but the target by December 2025 should be around $3200 – $3300. In rupee terms the target for December 2025 should be close to Rs 92,000 – Rs 93,000 per 10 grams (due to expected rupee appreciation) with USDINR expected to be in the range of 83.50 – 84.50 by December 2025,” he told TOI.

After the year end 2025 corrections, with the impact of tariffs and economic slowdown across the globe, we could witness the safe haven demand for gold to surge in the year 2026 wherein we expect gold prices to surpass $4000 an ounce (Ranging between $3800 – $4200) an ounce, he added.

Naveen Mathur of Anand Rathi still sees room for a 10-15% rise in gold prices from current levels. $3800 – 3850 per oz in spot translating to levels of Rs 1,05,000 – 1,08,000 per 10 gm in the domestic markets, still looks possible till December 2025 end, he says.

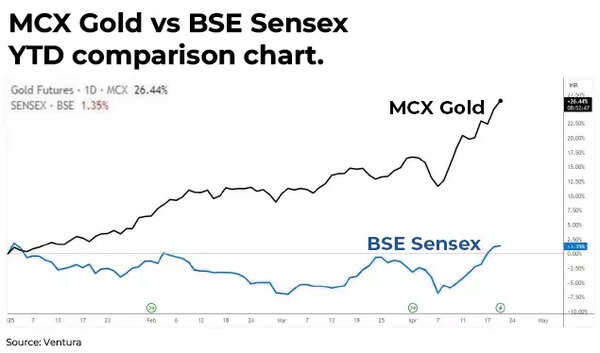

MCX Gold VS BSE Sensex

According to Mathur, the current rally has been too fast as the rise from Rs 90,000 to Rs 1 lakh was seen only under the last 12 trading days while the run from Rs 80,000 to Rs 90,000 took about 77 days. “This indicates price corrections of up to 5-10 % which could be seen in the coming weeks,” he told TOI.

Manav Modi, Senior Analyst, Commodity Research at Motilal Oswal Financial Services Ltd believes gold could inch towards $3350-3500 and consolidate near the same. “However, looking at the momentum, a rally towards $3700 over the long term can also not be ruled out. Assuming USDINR at 85, on the domestic front, immediate range is near Rs 96500- 1,00,000. From a longer term perspective, Rs 1,06,000 could be possible,” he says.

Also Read | Gold prices at record high! Sovereign gold bond investors weigh profit booking with 221% returns

Gold @ Rs 1 lakh: Should you buy or sell?

Abhilash Koikara of Nuvama Professional Clients Group advocates buying gold on dips. “We may witness shallow corrections in the coming days till $3,380 (approximately Rs 96,800)- $3,300 (approximately Rs 94,800) and such corrections must be used as a buying opportunity for medium/long term horizon for the specified targets,” he tells TOI.

NS Ramaswamy of Ventura says that with gold touching Rs 1 lakh, investors could either hold their long position or book profits to initiate a buy position in the range of Rs 92,500 – Rs 94,000 levels.

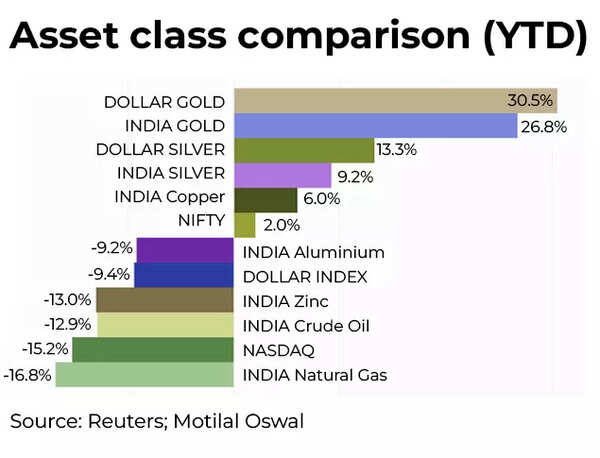

Asset Class Comparison

“Fresh buying at the present levels of Rs 98,000 to Rs 1,00,000 lakh is not recommended. Bottom fishing could be done at Rs 92,500 to Rs 94,000 levels,” he says.

Manav Modi of Motilal Oswal also advocates the same strategy for gold investors. “If you are a new investor in gold, then a buy on dips strategy is the best way forward. Investors should definitely not sell, because the long term outlook is strong. For existing gold investors, partial profit booking and then re-entry at dips may be the right strategy,” he tells TOI.

Anand Rathi’s Naveen Mathur says gold remains a long term buying opportunity for investors. “We suggest investors continue to buy gold at regular intervals considering it as a portfolio diversifier against other asset classes from a long term perspective,” he concludes.

(Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)

More Stories

Dow soars over 1000 points, Nasdaq rallies over 4% as Trump softens stance on Fed chair, China tariffs

India, US to hold formal talks on bilateral trade agreement in Washington amid Donald Trump’s tariff threat

RBI directs banks to adopt ‘.bank.in’ domain for safer digital transactions by October 31, 2025 | India-Business News