The reason is straightforward: It will cost insurance companies more to replace damaged car parts that are subject to tariffs.

“When you get into an accident, your car insurance company is the one that’s going to be buying those parts to repair your vehicle,” said Terence Lau, dean of Syracuse University’s College of Law, who was previously a trade lawyer for Ford Motor Co. “Many products are imported, and so I expect that will see some upward pressure on car insurance premiums.”

Tires are one example. Nearly 80% of the world’s natural rubber exports come from five countries: Thailand, Indonesia, Ivory Coast, Vietnam and Malaysia. That means U.S.-based tire plants will have to pay more for the raw materials they depend on overseas suppliers to provide.

Many vehicles are vulnerable to multiple Trump administration tariff policies; from those on the auto industry itself to separate levies on steel and aluminum, looming taxes on chips and sweeping duties on global imports, some of which the White House has temporarily ratcheted back.

The auto industry’s extensive international supply chains mean that there’s no vehicle that is built entirely domestically with American-made parts. Almost 7 in 10 new cars are assembled abroad, according to an NBC News analysis of National Highway Traffic Safety Administration data. And many as 6 in 10 replacement parts are imported, data from the American Property Casualty Insurance Association shows.

Automobiles have been flying off dealers’ lots as consumers try to get ahead of Trump’s tariffs. The daily supply of new vehicles, a common inventory metric, plunged from 91 days at the beginning of March to 70 days in April, according to Cox Automotive. Used vehicle inventories declined from 43 to 39 days, the group found.

As people hang on to their vehicles longer, industry experts expect demand for used vehicles to surge, which could drive up prices in that market, too.

“If you’re doing the fiscally responsible thing and driving a vehicle that’s maybe 10 or 15 years old until the wheels fall off, the cost of general upkeep will increase,” said Ivan Drury, director of insights at Edmunds.

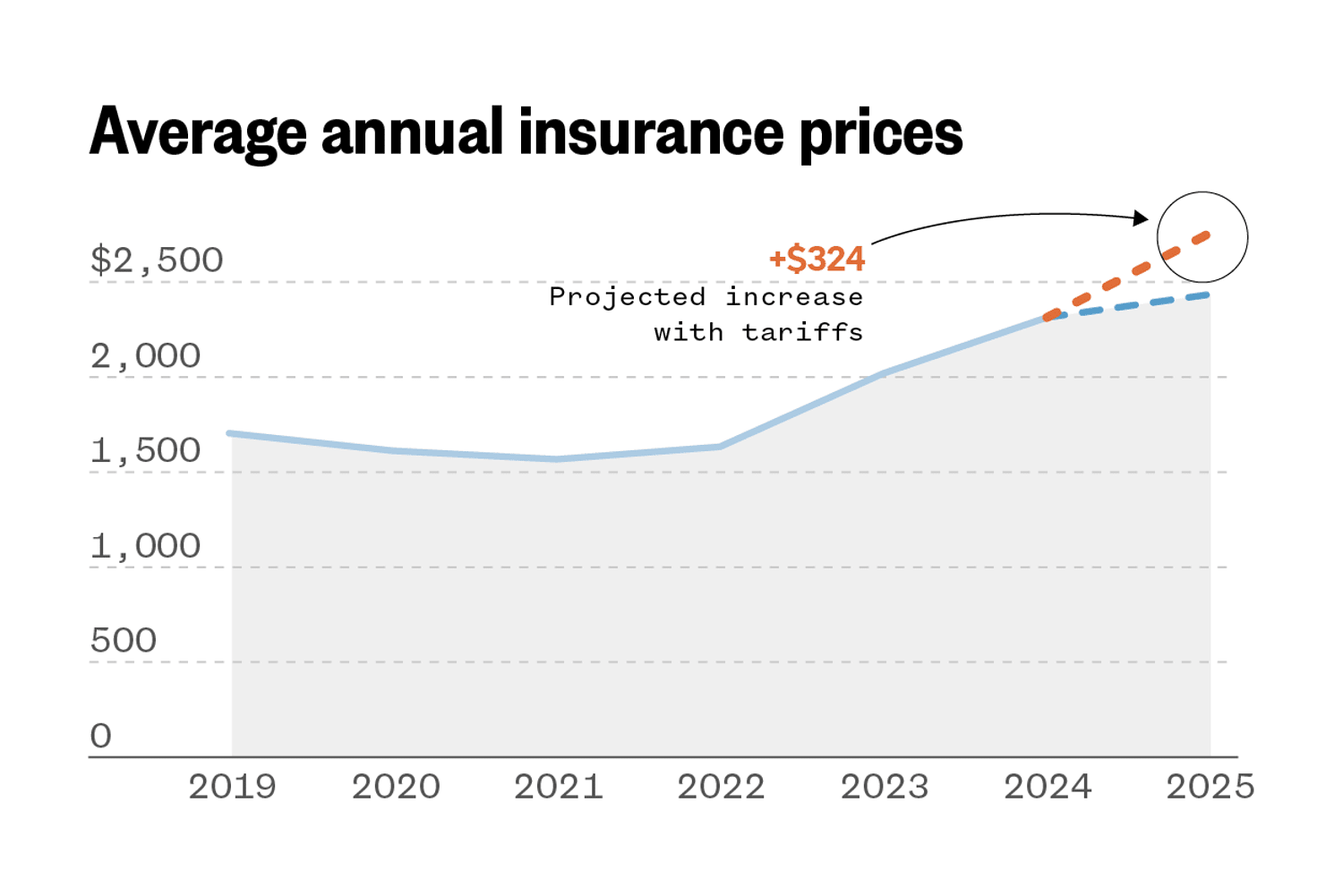

Drivers whose insurance policies are set to be renewed later in the year are likely to see some of the first price hikes, experts say. Those expected hikes could vary by state, with New York and Florida set to see the steepest ones, according to estimates from Insurify.

More Stories

‘Yeah, keep running,’ the gunman said

Judge orders detained Tufts student Rumeysa Öztürk to be transferred back to Vermont

Roommate of slain Idaho students will be allowed to testify that murder suspect had ‘bushy eyebrows’